The Australian edition of the Citi Premier Card is a solid rewards credit card with an effective earn rate of up to 1 airline mile per dollar. With frequent sign up bonuses and a suite of benefits including two Priority Pass lounge visits and mobile phone insurance, this is a card worth considering.

In this post:

Citi Premier Card (Australia) Basics

Sign Up Bonus

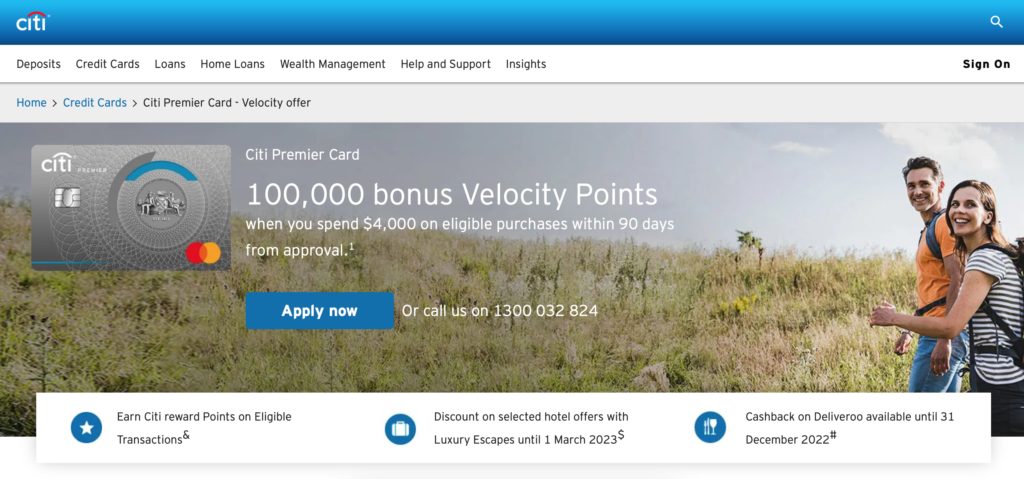

Citibank offer a range of sign up bonuses for the Premier Card with recent offers including:

- 100K Velocity points after $4,000 spend in 90 days

- 80K Qantas points after $4,000 spend in 90 days

- $600 cashback after $4,000 spend in 90 days

Eligibility

Interestingly, there is no waiting period between cards to be eligible for the Citibank bonuses, but anecdotally any application within 6 months of a new card (including white labelled products like Qantas Money) will be automatically declined.

Given NAB bought Citibank’s Australian business in June 2022, we can expect a revision in policy shortly.

Annual Fee

The standard annual fee is A$300, with a $50 premium for the Qantas direct earn version of the card. Cashback offers often include a reduced annual fee.

Earning Points With Citi Premier Card

Mastercard credit cards that earn 1 airline mile per $1 spent are relatively rare, making the Citi Premier a good option for organic spend.

2 x Points On Online Spend

Citi Premier earns 2 points per dollar on online spend. While most cards focus on certain categories (e.g. supermarkets, department stores and restaurants) for bonus points, online spend is more useful.

2 x Points On International Spend

You’ll also earn 2 points per dollar on international spend, which is an increasingly common bonus category. Comparable cards including the CommBank Ultimate Awards card also offer higher earn rates on international spend.

Annual Points Cap

An annual earning cap of 200,000 Citi points is worth noting for higher spenders. If you spend less than A$100,000 per year on your credit card, there will be no impact.

Citi Premier Card Australia | Airline Earn Rates

Below are the effective earn rates per $1 Australian dollar spent.

| Airline | Online Spend | International Spend | Domestic Spend |

| Qantas Frequent Flyer | 1 | 1 | 0.5 |

| Virgin Australia Velocity | 1 | 1 | 0.5 |

| Singapore Airlines KrisFlyer | 0.8 | 0.8 | 0.4 |

| Emirates Skywards | 0.8 | 0.8 | 0.4 |

Citi Premier Australia Benefits

The Citi Premier card provides a number of useful benefits for cardholders.

Priority Pass Membership

Two complimentary lounge visits per year through a Priority Pass membership. Useful when departing Sydney T1 International or transiting through Singapore Changi airport.

Registration is done via prioritypass.com/premieraumc and your Digital Membership is active immediately.

Complimentary Mobile Phone Insurance

Citibank is one of the few card issuers in Australia to include mobile phone insurance, which covers accidental damage and theft. By comparison, the American Express coverage is limited to screen damage.

Citi PayAll

Citibank offers an alternative way to pay rent, taxes, fees and bills through Citi PayAll, and is offering fee free payments until 31 October 2022. Drew is a power user.

Citibank Premier Card Australia Bottom Line

The Citibank Premier Card combines a rare earn rate of up to 1 airline point per dollar with a package of benefits including Priority Pass lounge visits and mobile phone insurance.