The HSBC Star Alliance Credit Card is unique in offering elite frequent flyer status solely through credit card spending and currently only available in Australia.

In most other respects, the product is a fairly standard rewards credit card so our review will focus on the unique features and benefits of the HSBC Star Alliance Credit Card.

In this post:

HSBC Star Alliance Credit Card Review

The HSBC Star Alliance Credit Card is the easiest way to earn Star Alliance elite status and with it key perks such as priority check in, lounge access and priority boarding across all Star Alliance member airlines. Star Alliance has two levels of alliance-wide status and are earned at the following thresholds:

- $4,000 spend in the first 90 days for Star Alliance Gold, and subsequently:

- $60,000 spend per year for Star Alliance Gold

- $30,000 spend per year for Star Alliance Silver

Usually requiring around 50,000 miles flown per year to attain, the benefits of Star Alliance Gold make for a much more comfortable journey as Ben Schlappig at One Mile At A Time has articulated in his guide.

Spending also accrues reward points in the new Star Alliance Rewards program, which are then transferable to seven participating Star Alliance airline frequent flyer programs, including Singapore Airlines, Air Canada and United. Being able to warehouse points and transfer them to specific frequent flyer programs when needed is useful and avoids points orphaning and hard expiry dates.

Earn rates for the card are tiered:

- 1 Star Alliance Point per $1 up to $3,000 in a statement

- 0.5 Star Alliance Point per $1 above $3,000

Though conversion of Star Alliance Point to most participating programs is 1 to 0.8 so your effective earn rate taking Singapore Airlines as an example is:

- 0.8 KrisFlyer Miles per $1 up to $3,000 in a statement

- 0.4 KrisFlyer Miles per $1 above $3,000

Participating airlines are:

Fast Track To Star Alliance Gold

Spending $4,000 on eligible purchases within 90 days of account opening is all it takes to achieve Star Alliance Gold in the first year.

HSBC advises that eligible purchases exclude interest free and other promotions, balance transfers, cash transfers, business expenses, cash advances, fees and charges, BPAY®, any disputed transactions and government fees and charges.

Once you hit the spending milestone, you receive email confirmation and an invitation to select the Star Alliance frequent flyer program for your status. You have 14 days to nominate the program, after which your status upgrade to Star Gold status should appear within 3-10 days.

Best Star Alliance Gold Options

Not all frequent flyer programs are created equal and three stand out for Australian travellers when nominating a participating program for their Star Alliance Gold status.

Air Canada Aeroplan 50K

Aeroplan 50K is the best all round choice as it offers:

- Longest status validity of up to 23 months (remainder of the current calendar year and all of the following calendar year)

- Virgin Australia lounge access when travelling domestically for the member plus guest (buying this access via an annual Virgin Lounge membership would cost $399)

- eUpgrade credits for upgrading Air Canada flights (Prince of Travel has a great guide)

- Complimentary upgrade to Gold Leaf service on the iconic Rocky Mountaineer train (potentially worth $1,000+)

Singapore Airlines KrisFlyer Elite Gold

KrisFlyer Elite Gold would be the second best option as it offers:

- Virgin Australia lounge access when travelling domestically for the member plus guest (buying this access via an annual Virgin Lounge membership would cost $399)

- Complimentary Forward Zone seat selection and 15% off Extra Legroom seats on Singapore Airlines flights (MileLion has a great guide)

- Fast track to Shangri-La Jade elite status for complimentary breakfast after one stay via Infinite Journeys

United Premier Gold

United Premier Gold rounds out the podium positions with:

- Virgin Australia lounge access when travelling domestically for the member plus guest (buying this access via an annual Virgin Lounge membership would cost $399)

- Complimentary access to EconomyPlus seats at booking on United flights (which gives you an extra 3-4 inches of legroom compared to standard Economy)

- Complimentary Marriott Bonvoy Gold Elite status

The key drawback of Premier Gold is no access to United’s own United Club lounges when travelling within the US.

What Are My Other Options?

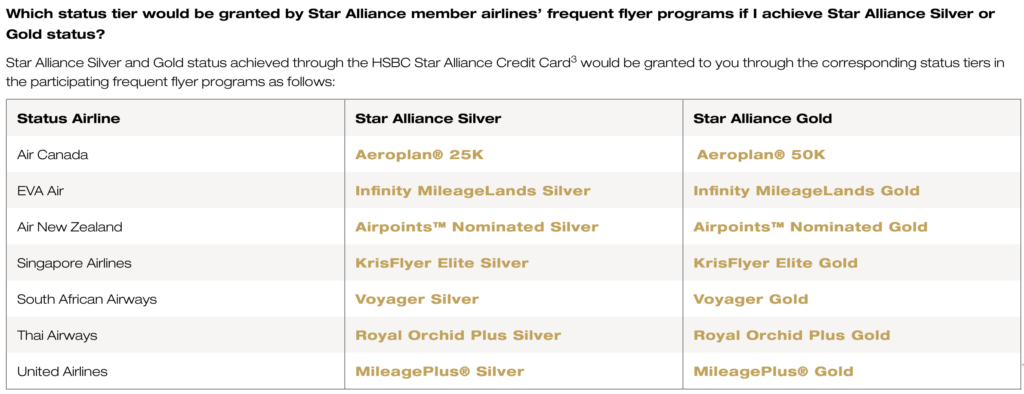

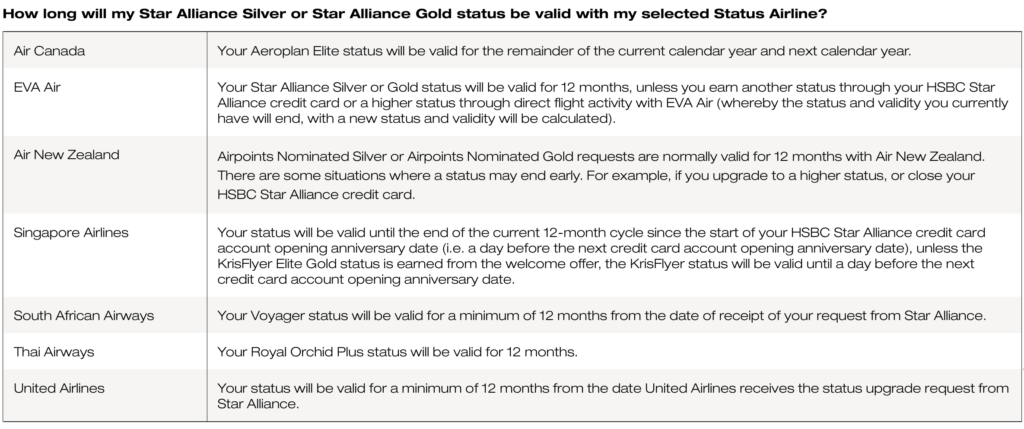

The full table of options for both Star Alliance Silver and Gold is below, along with status validity for each program:

0% Interest For 6 Months On Direct Flight Bookings

Bookings made on the websites of participating Star Alliance carriers are interest free for up to 6 months when paid for using the HSBC Star Alliance Credit Card.

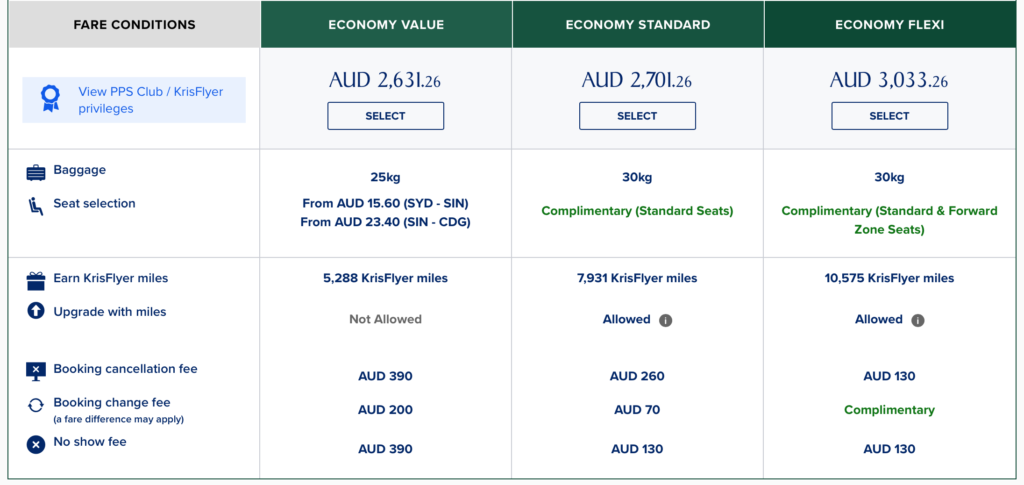

I think this is an underrated feature and allows you to manage cash flow while essentially purchasing an option on a flight for the price of the cancellation fee (if any). Doing this locks in a ceiling price for your flights and still allows you to take advantage of any sale fares or premium award seats that come up between booking and travel dates.

In the below example for Sydney to Paris on Singapore Airlines, the cost of the option would be between $130 to $260.

Travel Insurance

The standard suite of insurance is included with the HSBC Star Alliance Credit Card, with $500 in prepaid travel costs is all that is required to activate the International Travel Insurance coverage. Domestic Travel Insurance is activated by spending $250 in prepaid travel costs or the full price of your domestic airfare if under that amount.

Personally, I am more comfortable with the automatic cover included with a CommBank credit card or a standalone policy.

Fees & Charges

Below are the fees and charges for the HSBC Star Alliance Credit Card, which are fairly standard for a rewards card in Australia.

The 3% foreign currency fee is on the higher side, making the CommBank Ultimate Awards card a better choice for overseas spending.

| Feature | Details |

| Annual Credit Card Fee | $0 in the first year ($450 thereafter) |

| Cash Advance Fees | The higher of 3% or $4 |

| Interest Free Period on purchases | Up to 55 days |

| Interest Rate for Cash Advances | 21.99% p.a. |

| Interest Rate for Purchases | 19.99% p.a. |

| Late Payment Fees | $30 |

| Minimum Credit Limit Offered | $6,000 |

| Minimum Income Requirement | $75,000 p.a. |

| Multiple additional cards for family or friends over 16 years | Yes (no fee) |

| Overseas Exchange Fees | 3% |

| Rewards Program | Yes – Star Alliance Rewards |

HSBC Star Alliance Credit Card Pros & Cons

Pros

- $0 Annual Fee in the first year

- Fast Track to Star Alliance Gold after $4,000 spend in first 90 days

- Virgin Australia Lounge access when selecting Air Canada Aeroplan, Singapore Airlines Kris Flyer or United Mileage Plus as your Star Alliance Gold program

- 0% Interest for 6 Months on Airfares purchased on participating airline websites

- Star Alliance Rewards points transferable to 7 Star Alliance frequent flyer programs

Cons

- $60,000 annual spend to maintain Star Alliance Gold status in subsequent years

- Reduced points earn above $3K spend per month

- 3% Overseas Transaction Fee

HSBC Star Alliance Credit Card Review Summary

The HSBC Star Alliance Credit Card is the easiest way to earn Star Alliance Gold elite status and unlock lounge access and priority check in and boarding after $4,000 spend in the first 90 days. With a $0 annual fee and reasonable points earning rate, the card is great for the infrequent traveller while they build up their frequent flyer points balance.